The Goertzel Algorithm is a digital signal processing (DSP) algorithm used to efficiently compute individual terms of the Discrete Fourier Transform (DFT), particularly when only a few frequency components are of interest. It is widely used in applications such as tone detection (e.g., DTMF tones in telecommunication) and other spectral analysis tasks.

Applications

- Tone detection: Used in systems like Dual-Tone Multi-Frequency (DTMF) detection in telecommunication.

- Spectral analysis: Efficiently identifies the presence of specific frequency components in a signal.

- Signal processing in embedded systems: Its low computational requirements make it ideal for resource-constrained environments.

The Goertzel algorithm is used in these applications because it offers several advantages over other methods, such as the FFT:

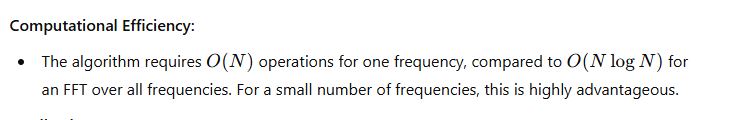

1. Computational efficiency: The Goertzel algorithm requires fewer calculations when detecting a small number of frequency components, making it more computationally efficient than the FFT in these cases.

2. Real-time analysis: The algorithm can be implemented in a streaming fashion, allowing for real-time analysis of signals, which is crucial in applications like telecommunications and audio processing.

3. Memory efficiency: The Goertzel algorithm requires less memory than the FFT, as it only computes the frequency components of interest.

4. Precision: The algorithm is less susceptible to numerical errors compared to the FFT, ensuring more accurate results in applications where precision is essential.

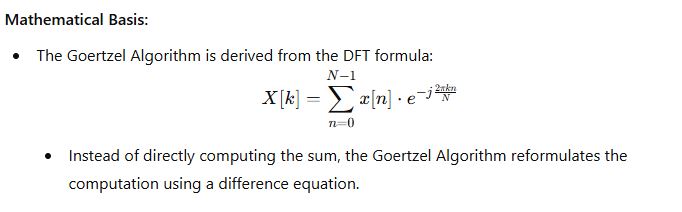

Key Features of the Goertzel Algorithm

Focus on Specific Frequencies

- Unlike the Fast Fourier Transform (FFT), which computes all frequency bins, the Goertzel Algorithm is optimized for calculating specific frequency components.

- This makes it computationally efficient for detecting tones or analyzing a small set of frequencies in a signal.

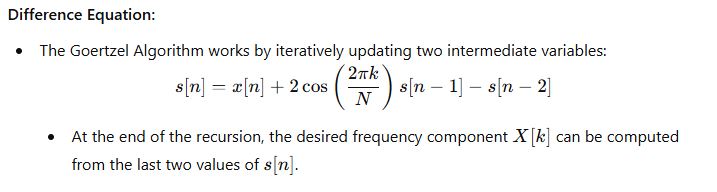

Recursive Nature

- The algorithm uses a recursive filter structure, reducing the computational overhead compared to directly evaluating the DFT for specific frequencies.

Advantages

- Efficiency: Optimized for analyzing a few frequencies.

- Low Memory Usage: Operates using a small number of state variables.

- Simplicity: Easy to implement in hardware or software.

Disadvantages

- Limited Use Cases: Not suitable for scenarios requiring a complete spectrum analysis.

- Precision Issues: Prone to numerical instability in certain conditions, particularly with fixed-point arithmetic or very high-frequency resolutions.

Application of Goertzel Algorithm in Quantitative Finance

In quantitative finance, the Goertzel algorithm has been utilized for uncovering hidden market cycles, developing data-driven trading strategies, and optimizing risk management. This section delves deeper into the applications of the Goertzel algorithm in finance, particularly within the context of quantitative trading and analysis.

Unveiling Hidden Market Cycles:

Market cycles are prevalent in financial markets and arise from various factors, such as economic conditions, investor psychology, and market participant behavior. The Goertzel algorithm’s ability to detect and isolate specific frequencies in price data helps trader analysts identify hidden market cycles that may otherwise go unnoticed. By examining the amplitude, phase, and periodicity of each cycle, traders can better understand the underlying market structure and dynamics, enabling them to develop more informed and effective trading strategies.

Developing Quantitative Trading Strategies:

The Goertzel algorithm’s versatility allows traders to incorporate its insights into a wide range of trading strategies. By identifying the dominant market cycles in a financial instrument’s price data, traders can create data-driven strategies that capitalize on the cyclical nature of markets.

For instance, a trader may develop a mean-reversion strategy that takes advantage of the identified cycles. By establishing positions when the price deviates from the predicted cycle, the trader can profit from the subsequent reversion to the cycle’s mean. Similarly, a momentum-based strategy could be designed to exploit the persistence of a dominant cycle by entering positions that align with the cycle’s direction.

Enhancing Risk Management:

The Goertzel algorithm plays a vital role in risk management for quantitative strategies. By analyzing the cyclical components of a financial instrument’s price data, traders can gain insights into the potential risks associated with their trading strategies.