What Is An Invoice?

An invoice is a document that details the products and services provided by a business to a client and establish an obligation on the part of the client to pay the business for the products and services. In other words, an invoice is a bill that a buyer of goods and services must pay the seller or supplier.

An invoice indicates that a buyer owes money to a seller or service provider. From a seller’s point of view, an invoice for the sale of goods or service is called a Sales invoice whereas from a buyer’s point of view an invoice for the cost of goods or services incurred is called a purchase invoice.

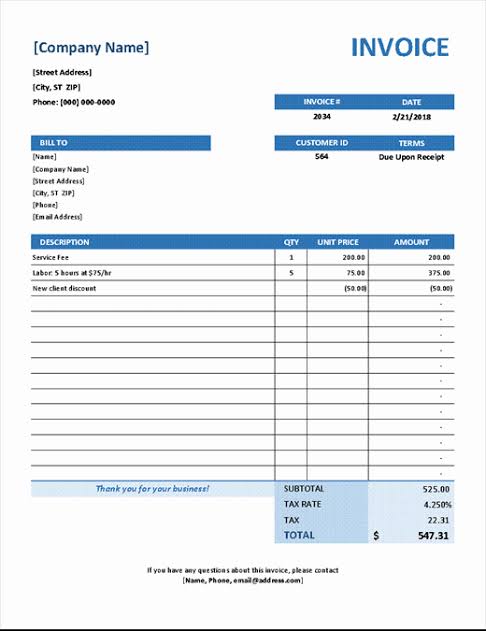

Typically, an invoice has a unique identifier referred to as the invoice number that is used for internal and external reference. An invoice typically contains contact information for the seller or service provider in case there is an error relating to the billing.

Payment terms may be outlined on the invoice, as well as the information relating to any discounts, early payment details or finance charges assessed for late payments. It also presents the unit cost of each item, total units purchased, freight, handling, shipping and associated tax charges, and it outlines the total amount due. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal and provides information on the available methods of payment.

What You Need To Know About Invoice

- An invoice is a document issued by a seller to a buyer, relating to a sale transaction and indicating the products, quantities and agreed prices for products or services the seller had provided the buyer.

- An invoice is a source document in accounting process.

- Invoices are used in commercial trade to request payment for items that have actually been sold by showing the amount that should actually be paid.

- An invoice is issued before payment is made.

- The objective of issuing an invoice is to inform the buyer that payment is due for the goods and services provided.

- The terms of a regular invoice are final and cannot be modified.

- Regular invoice is legally binding upon parties.

- Invoice can be regarded as a request or demand for payment (Bill).

- Invoice is used as evidence of transaction between seller and buyer.

- Invoice is not subject to objection.

- An invoice shows the final amount that should be paid.

- A commercial invoice may look almost exactly to a Proforma invoice, however, it is not a must for it to be labeled ‘’ Invoice.’’ It can be labeled ‘’Bill’’, ‘’Service Charge’’ etc.

- Customers/buyers use invoice statement to pay bill, and will keep it for tax and as an expenditure record.

- The invoice is issued by the seller only for goods and services agreed upon with the buyer.

What Is A Proforma Invoice?

A Proforma invoice is a document issued by the seller to the buyer that provides information regarding the description of goods which are yet to be delivered. It is essentially a preliminary bill of sale. A Proforma invoice declares the seller’s commitment to provide the goods or services specified to the buyer at certain prices. In other words, it is issued as a preview of the invoice. A firm may also use a Proforma invoice if the sales contract terms specify that full payment is not due until the buyer receives certain goods.

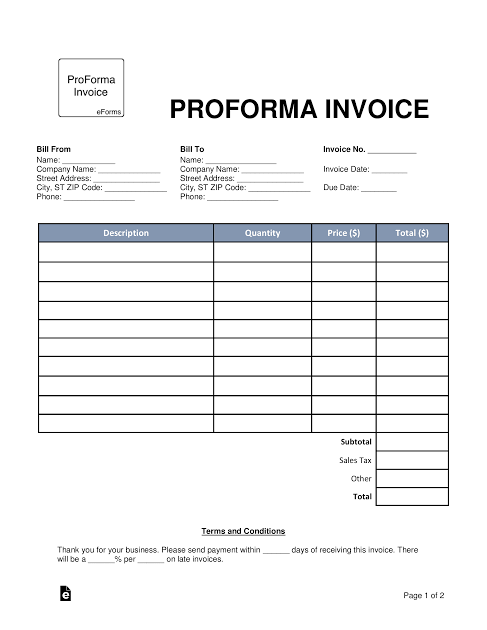

It typically contains a date of issue, a description of what is being sold and the total amount payable as well as any taxes or fees that may be incurred between the time of issuing and when the delivery is made. Although Proforma invoice may be subject to changes, it represents good faith estimates; it provides as precise an estimate as possible with the main objective being to avoid exposing the customer to any unanticipated charges or duties once the transaction is final.

While a Proforma invoice does contain exact cost details associated with the sale, it is not an official demand for payment. Proforma invoice is not legally binding upon parties. It is not a requirement by law in many countries. It is only issued for convenience and as a part of best practices in business. No guidelines dictate the exact presentation or format of a Proforma invoice and it may or may not resemble other commercial invoices, however, it is a must for it to be labeled ‘’Proforma Invoice.’’

What You Need To Know About Proforma invoice

- Proforma Invoice is a document that details the available product/services and their respective prices from the supplier to an enquiring customer.

- A Proforma invoice proves the credibility of the values indicated in the invoice, thus it cannot be used as a source document in accounting process.

- Proforma invoices are commonly used in exporting and importing business, especially when the buyer and the seller don’t have a history of working together.

- Proforma invoice is issued before goods are delivered to the buyer.

- The objective of issuing a Proforma invoice is to provide information regarding the description of goods which are yet to be delivered.

- The terms of Proforma invoice are temporary and subject to change.

- Proforma invoice is not legally binding upon parties. It is not a requirement by law. It is only issued for convenience and as a part of best practices in business.

- A Proforma invoice can be considered as a quotation, containing a list of quantity and prices items to be supplied by the seller.

- Proforma invoice is used for the creation of sale.

- Proforma invoice can be rejected by the buyer.

- A Proforma invoice provides an estimate of the final amount of an order.

- A Proforma invoice may look almost exactly to an invoice, however, it is a must for it to be labeled ‘’Proforma Invoice.’’

- Importers use Proforma invoices when declaring the value of goods in a shipment for customs clearance.

- A seller may provide a Proforma invoice in situation in which it is impossible to predict an exact price, but it is possible to give a general idea of upcoming charges.

Also Read: Difference Between Promissory Note And Bill Of Exchange

Difference Between Invoice And Proforma Invoice In Tabular Form

| BASIS OF COMPARISON | INVOICE | PROFORMA INVOICE |

| Description | An invoice is a document issued by a seller to a buyer, relating to a sale transaction and indicating the products, quantities and agreed prices for products or services the seller had provided the buyer. | Proforma Invoice is a document that details the available product/services and their respective prices from the supplier to an enquiring customer. |

| Source Document | An invoice is a source document in accounting process. | A Proforma invoice proves the credibility of the values indicated in the invoice, thus it cannot be used as a source document in accounting process. |

| Application | Invoices are used in commercial trade to request payment for items that have actually been sold by showing the amount that should actually be paid. | Proforma invoices are commonly used in exporting and importing business, especially when the buyer and the seller don’t have a history of working together. |

| Issuance | An invoice is issued before payment is made. | Proforma invoice is issued before goods are delivered to the buyer. |

| Objective | The objective of issuing an invoice is to inform the buyer that payment is due for the goods and services provided. | The objective of issuing a Proforma invoice is to provide information regarding the description of goods which are yet to be delivered. |

| Terms | The terms of a regular invoice are final and cannot be modified. | The terms of Proforma invoice are temporary and subject to change. |

| Legal Implication | Regular invoice is legally binding upon parties. | Proforma invoice is not legally binding upon parties. |

| Implication | Invoice can be regarded as a request or demand for payment (Bill). | A Proforma invoice can be considered as a quotation, containing a list of quantity and prices items to be supplied by the seller. |

| Use | Invoice is used as evidence of transaction between seller and buyer. | Proforma invoice is used for the creation of sale. |

| Objection | Invoice is not subject to objection. | Proforma invoice can be rejected by the buyer. |

| Intention | An invoice shows the final amount that should be paid. | A Proforma invoice provides an estimate of the final amount of an order. |

| Format | A commercial invoice may look almost exactly to a Proforma invoice, however, it is not a must for it to be labeled ‘’ Invoice.’’ It can be labeled ‘’Bill’’, ‘’Service Charge’’ etc. | A Proforma invoice may look almost exactly to an invoice, however, it is a must for it to be labeled ‘’Proforma Invoice.’’ |

| Other Use | Customers/buyers use invoice statement to pay bill, and will keep it for tax and as an expenditure record. | Importers use Proforma invoices when declaring the value of goods in a shipment for customs clearance. |

| Issuance | The invoice is issued by the seller only for goods and services agreed upon with the buyer. | A seller may provide a Proforma invoice in situation in which it is impossible to predict an exact price, but it is possible to give a general idea of upcoming charges. |