What is Capital Reserve?

A capital reserve is a line item in the equity section of a company’s balance sheet that indicates the cash on hand that can be used for future expenses or to offset any capital losses.

It is derived from the accumulated capital surplus (capital gains) of a company and profits generated from sale of assets, revaluation of assets, premium obtained from the sale of current assets or other non-trading activities or non-operating activities. For this reason, capital reserves can’t be seen as an indicator of operational efficiency.

These reserves are not meant to distribute as dividends, and they are set aside for specific purposes aimed at strengthening the financial position of the company. The capital reserve can be set aside for other long-term investments and unpredictable expenses.

Profit/gain on Capital Reserve examples:

- Profit or gain on sale of fixed capital or investment.

- Pre-incorporation Profit

- Premium on issue of securities

- Profit/gain on redemption of debentures.

- Profit or gain on the reissue of forfeited shares

- Profit/gain on revaluation of assets and liabilities.

Some of the common uses of capital reserves include:

- Expansion – Companies can use capital reserves to finance expansion plans such as acquiring new assets, opening new branches, or entering new markets.

- Research and Development – Capital reserves can be used to fund research and development activities aimed at developing new products, improving existing ones, or discovering new technologies.

- Capital expenditure – Capital reserves can be used to finance capital expenditures such as upgrading infrastructure, purchasing new equipment, or renovating existing facilities.

- Emergency funds – Capital reserves can be used as a cushion for unexpected financial needs or emergencies such as economic downturns, natural disasters, or unforeseen liabilities.

- Share buybacks – Capital reserves can be used to buy back shares from shareholders, which can help to increase the value of remaining shares by reducing the number of shares outstanding.

What is Revenue Reserve?

A Revenue Reserve is a portion of a company’s net profits that is set aside and retained within the business and kept for meeting future requirements of the business. This reserve is not distributed to shareholders in the form of dividends.

The reserve is created by allocating a portion of the company’s net income after taxes to a specific account on the balance sheet. The reserves can be used for financing future projects, expansions, or acquisitions without relying on external sources of funding.

Retaining a portion of profits as reserves can act as a buffer against unforeseen economic downturns, dissolution of the company or take advantage of investment opportunities that arise in the future. Companies with cyclical revenue patterns may use revenue reserves to smooth out dividend payments, ensuring a more consistent payout to shareholders over time.

Also, revenue reserves can be used to pay down debt, reducing interest expenses and improving the company’s financial position.

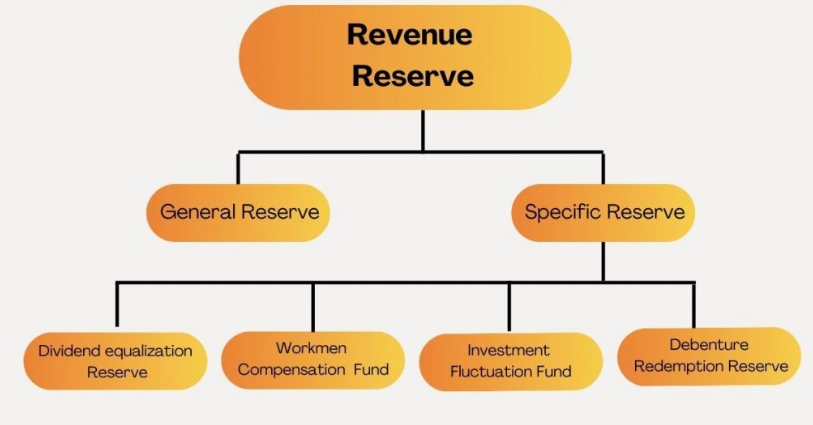

Classification of Revenue Reserve

Capital Reserve vs Revenue Reserve: Key Differences

| Feature | Capital Reserve | Revenue Reserve |

|---|---|---|

| Nature of Source | Generated from capital profits or non-trading activities | Derived from revenue profits or trading activities |

| Purpose | Created to strengthen the financial structure | Used for various operational needs and contingencies |

| Types | General capital reserve, specific capital reserve, etc. | General reserve, specific reserve, contingency fund, etc. |

| Usage Restrictions | Typically used for specific purposes, like asset replacement, expansions, etc. | More flexibility in usage, covering day-to-day expenses, dividends, etc. |

| Durability | Intended for long-term stability and security | May be used for short-term or ongoing operational needs |

| Reversal or Utilization | Less likely to be utilized or reversed | More likely to be utilized or transferred as dividends |

| Requirements | There are no such requirements for establishing a capital reserve. | To generate reserve capital, a specific permission/resolution must be obtained. |

| Financial Statement Impact | Appears on the liabilities side of the balance sheet | Appears on the liabilities side of the balance sheet |